Bespoke Energy Trading Software That Actually Ships

Platform architecture validation. EPEX connectivity. Position management systems. Risk engines. Data infrastructure. We build the custom energy trading software and ETRM integrations that off-the-shelf solutions can't deliver—without the 18-month timelines and £500k+ budgets of legacy vendors.

Modular engagements from £15k. Proven with Shell, Centrica, and LimeJump. Built by engineers who've sat on trading floors.

View Services Start with 2-Week SprintEnergy Trading Software & ETRM Development Services

Modular, fixed-scope engagements that de-risk your platform decisions and accelerate time-to-market. No 18-month waterfalls. No vendor lock-in.

Platform Architecture Validation

2 weeks | £15k-25k

Before committing £50k-200k to an ETRM implementation, get external validation. We evaluate platform options, design team structure, create phased roadmaps, and identify hidden risks. "Builder's Blind Spot" insurance for critical decisions.

Deliverable: Platform evaluation matrix, recommended architecture, team structure, implementation roadmap, risk assessment

Exchange Connectivity & Integration

Modular | £15k-40k per integration

EPEX SPOT, ICE, EEX connectivity. Order submission, trade capture, deal flow integration. Built modularly—start with one market, expand incrementally. De-risked by our Limejump EPEX implementation.

Deliverable: Exchange API integration, order management module, trade capture system, internal system connectivity

Bespoke Risk Management Systems

Per module | £15k-40k

Position monitoring, P&L calculation, exposure reporting, VaR engines, compliance dashboards. Custom to your portfolio structure. Individual tools, not full ETRM replacement.

Typical modules: Position aggregation engine, mark-to-market P&L, delta ladder reporting, stress testing, regulatory compliance

Centralized Data Infrastructure

4-8 weeks | £25k-80k

Multi-source data aggregation (market data, trades, positions), unified data model, API layer for downstream tools. Foundation for scalable trading operations.

Tech stack: Python, TimescaleDB/PostgreSQL, Kafka/event streaming, REST/GraphQL APIs, cloud-native deployment

Also Available:

Corporate Training & Team Bootcamps

4-6 weeks | £25k-50k. Custom team upskilling on energy trading fundamentals, ETRM architecture, Python for trading engineers.

Trading Desk Automation Sprint

2 weeks | Fixed scope. Rapid discovery, proof-of-concept, and implementation roadmap for day-ahead/intraday automation. Learn more

Example: GridSight Intelligence Platform

Proof-of-concept demonstrating our approach to building bespoke power trading software—from data ingestion to real-time analytics.

Real-Time Grid Intelligence & Historical Analysis

GridSight showcases our capability to build end-to-end trading platforms. It ingests data from Elexon BMRS and National Gas, processes it through high-performance pipelines (Python + TimescaleDB), and serves it via a web interface for strategic and tactical decision-making.

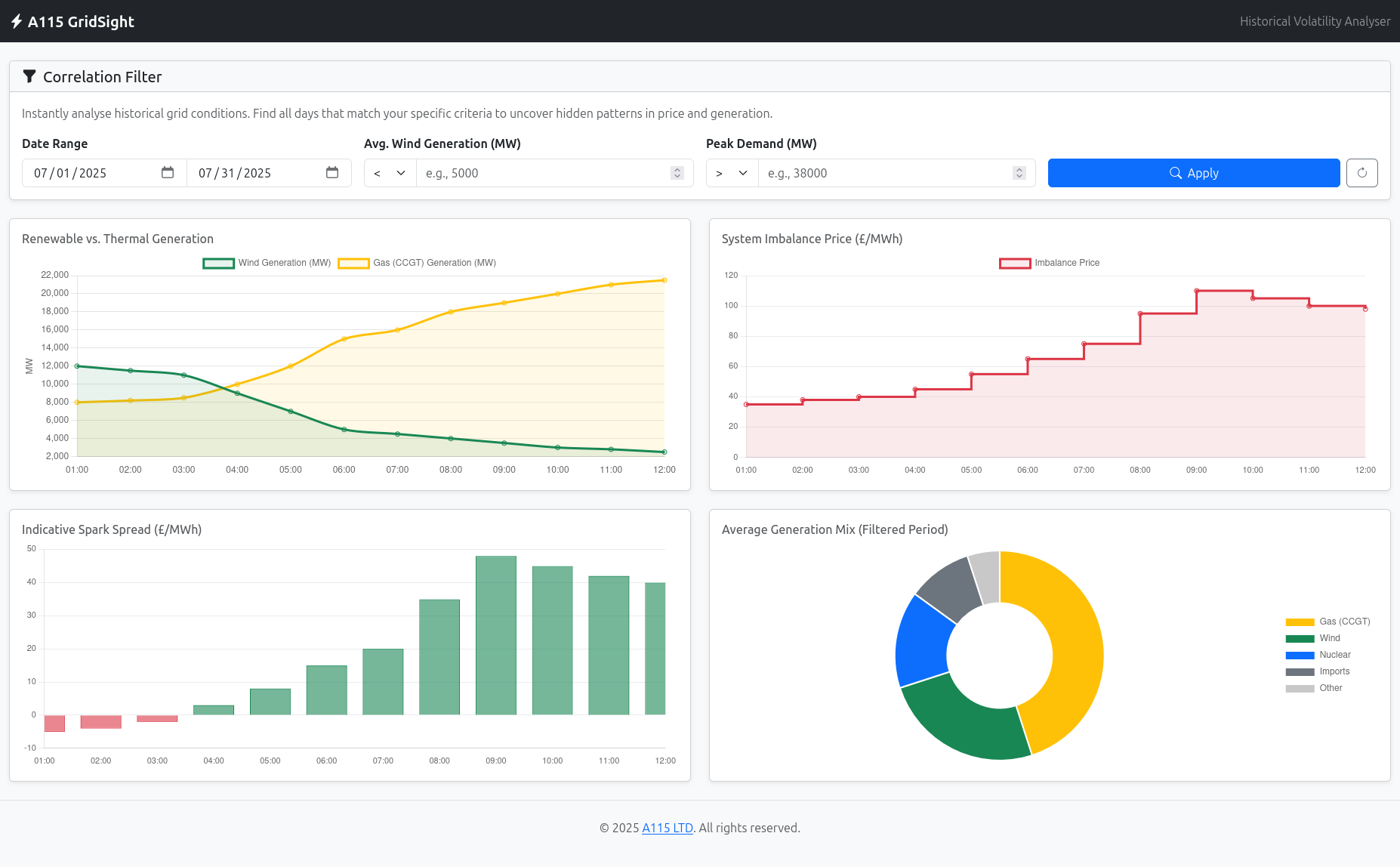

The Strategic View: Historical Analyser

Instantly answer: "What happened to prices the last time grid conditions were exactly like this?" Filter years of data to back-test scenarios in a single click.

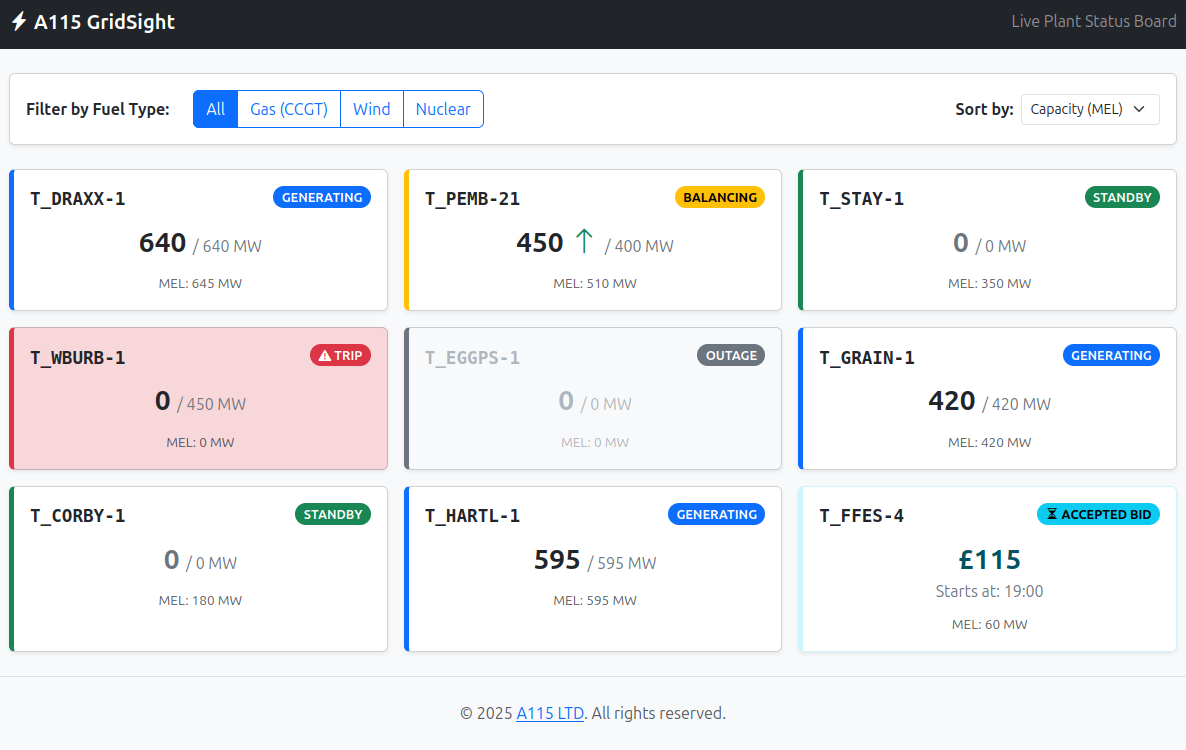

The Tactical View: Live Plant Status

Answer: "What is every major asset doing right now?" Get a real-time "bingo board" of every power plant, including forward-looking bids, to see scarcity before it happens.

Visualise the Entire Grid in Real-Time

GridSight provides the macro and micro views you need. Track the real-time spare capacity of the entire CCGT fleet with the System Headroom View to gauge system tightness at a glance, or drill down into individual asset status on the Live Plant Status Board to understand the minute-by-minute dynamics.

We achieve this by engineering high-performance data pipelines that ingest and process information directly from primary industry sources like Elexon's BMRS and National Gas. The platform is built on a robust, scalable foundation of Python, Django, and TimescaleDB to deliver the speed and reliability your desk demands.

- Real-time generation output by fuel type.

- Forward-looking accepted bids and offers in the BM.

- Live status updates: generating, outage, or trip.

Built with Analytical Rigor & Modern Engineering

Beyond just writing code, we bring systematic thinking to energy trading software development. Our approach combines structured analysis frameworks with modern cloud-native architecture—turning complex market requirements into production-ready systems that traders actually want to use.

GridSight demonstrates this approach: combining real-time data ingestion with historical pattern matching to surface trading opportunities. We build similar analytical depth into every bespoke system we deliver.

Why Trading Desks Choose A115

Proven Track Record

Built production systems at Shell, Centrica, LimeJump. We've sat on trading floors and understand the operational reality of energy markets.

Modern Tech Stack

Python, FastAPI, React, TimescaleDB, Kafka, AWS/cloud-native. Built for performance, scalability, and developer productivity.

Modular Approach

Start with one module (£15k-40k), prove value, expand incrementally. No multi-year commitments. No vendor lock-in.

Ready to Build Your Competitive Edge?

Whether you need platform architecture validation, exchange connectivity, risk management tools, or full bespoke energy trading software—we deliver production-ready systems without the legacy vendor timelines.